In today’s digital age, identity theft poses a significant threat, silently stealing personal information and causing widespread financial and emotional distress. Understanding the subtle signs and implementing proactive measures are crucial to safeguarding your identity. This guide provides nine essential tips to help you diagnose potential threats and proactively prevent identity theft, empowering you to take control of your personal information and secure your future.

From recognizing warning signs like unexplained account activity to employing robust password management and regularly monitoring your credit reports, we’ll cover a range of practical strategies. We’ll also explore recovery methods, including reporting procedures to credit bureaus and law enforcement, to minimize the impact should identity theft occur.

Recognizing the Signs of Identity Theft

Identity theft is a serious crime that can have devastating consequences. Victims often face significant financial losses, damage to their credit rating, and emotional distress. Recognizing the signs early is crucial to mitigating the damage and recovering from this crime. Being proactive and vigilant is your best defense.

Early detection is key to minimizing the impact of identity theft. Understanding the common indicators, both obvious and subtle, allows you to take swift action and protect yourself. The following table Artikels common indicators, while subsequent sections delve into more subtle signs often overlooked.

Common Indicators of Identity Theft

| Indicator Type | Description | Example | Action to Take |

|---|---|---|---|

| Financial | Unexplained charges or withdrawals from your bank accounts, credit cards, or other financial accounts. | A charge for a purchase you didn’t make appearing on your credit card statement. | Immediately contact your bank or credit card company to report the fraudulent activity. |

| Credit Report | Accounts opened in your name that you didn’t open, inquiries on your credit report from unknown sources, or changes to your credit report that you didn’t authorize. | A loan appearing on your credit report that you didn’t apply for. | Review your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) and dispute any inaccurate information. |

| Receiving bills or statements for accounts you don’t recognize, or missing mail containing financial documents. | Receiving a credit card statement for an account you didn’t open. | Contact the sender of the mail and report the issue. Consider forwarding suspicious mail to your local post office. | |

| Legal | Receiving collection notices for debts you don’t owe, or being contacted by debt collectors regarding accounts you don’t recognize. | A collection agency contacting you about a debt you never incurred. | Contact the debt collector and dispute the debt. Gather any documentation that proves you did not incur the debt. |

Subtle Signs of Identity Theft

Subtle signs of identity theft can be easily missed, leading to delayed detection and increased damage. For example, a slightly altered address on a bank statement might go unnoticed until significant fraudulent activity has occurred. Similarly, a small, unauthorized purchase might be overlooked amidst a flurry of legitimate transactions. These seemingly insignificant anomalies can be the first indicators of a larger problem. Consider scenarios where a tax return is rejected due to a previously filed return using your Social Security number, or a job application is denied due to a negative credit report resulting from fraudulent activity. These scenarios highlight the importance of meticulously reviewing all financial and personal documents.

Responding to Suspected Identity Theft

A flowchart illustrating the steps to take when suspecting identity theft would visually represent the process. The flowchart would begin with the question: “Do you suspect identity theft?” A “yes” branch would lead to steps including: reviewing financial statements, checking credit reports, contacting financial institutions, and reporting to the relevant authorities (such as the Federal Trade Commission (FTC) and the police). A “no” branch would advise continued vigilance and regular monitoring of financial accounts and credit reports. The flowchart would clearly Artikel the reporting procedures, emphasizing the importance of documenting all steps taken. This systematic approach helps individuals navigate the complex process of addressing identity theft effectively.

Implementing Protective Measures

Proactive steps are crucial in preventing identity theft. By taking control of your personal information and adopting secure practices, you significantly reduce your vulnerability to this serious crime. A multi-layered approach encompassing online security, financial vigilance, and informed decision-making forms the bedrock of a robust identity theft prevention strategy.

Implementing strong protective measures is paramount to safeguarding your personal information. A proactive approach, rather than a reactive one, is far more effective in preventing identity theft. This involves a combination of technological safeguards, mindful online habits, and diligent financial monitoring.

Proactive Strategies for Identity Theft Prevention

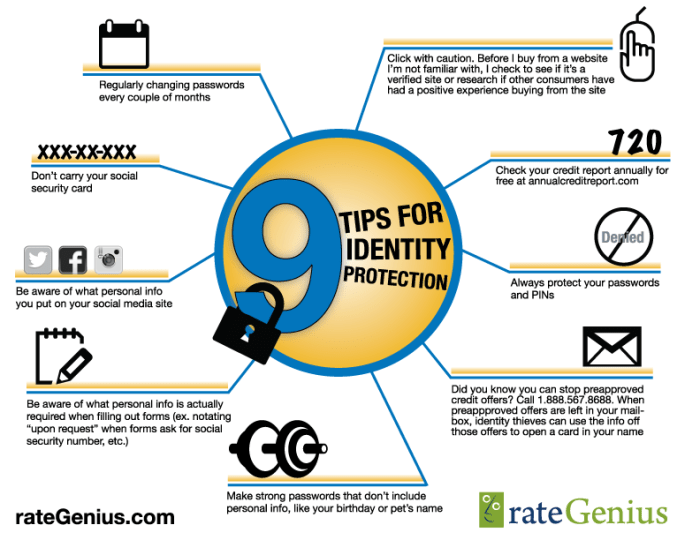

The following strategies provide a comprehensive approach to mitigating the risk of identity theft. Consistent application of these measures offers substantial protection.

- Strong and Unique Passwords: Utilize strong, unique passwords for all online accounts. A strong password is at least 12 characters long, includes a mix of uppercase and lowercase letters, numbers, and symbols. Consider using a password manager to generate and securely store these complex passwords.

- Secure Online Practices: Be cautious about phishing scams and avoid clicking on suspicious links or downloading attachments from unknown senders. Only use secure websites (those with “https” in the address bar) for online transactions and be wary of public Wi-Fi networks, as they are vulnerable to data interception.

- Regular Software Updates: Keep your operating system, antivirus software, and other applications updated. These updates often include security patches that protect against known vulnerabilities that hackers could exploit.

- Financial Monitoring: Regularly check your bank and credit card statements for any unauthorized transactions. Set up alerts for unusual activity on your accounts. This allows for prompt detection and reporting of any suspicious activity.

- Shred Sensitive Documents: Before discarding any documents containing personal information, such as bank statements, medical records, or tax returns, shred them using a cross-cut shredder to prevent identity thieves from reconstructing the information.

Credit Report Monitoring and Interpretation

Regularly monitoring your credit reports is a critical component of identity theft prevention. By reviewing your credit report, you can identify any fraudulent accounts or inquiries that might indicate identity theft. Early detection is crucial for minimizing the damage.

You can obtain your credit reports for free annually from each of the three major credit bureaus: Equifax, Experian, and TransUnion, through AnnualCreditReport.com. This is the only authorized website for free credit reports; avoid other sites that may charge a fee. Review each report carefully, paying close attention to any accounts or inquiries you don’t recognize. Look for inconsistencies in your address, employment history, or other personal information. If you find any discrepancies, immediately contact the credit bureau and the relevant financial institution to report the potential fraud.

Comparison of Identity Theft Protection Services

Several companies offer identity theft protection services, each with varying features and costs. Choosing the right service depends on your individual needs and budget. The following table compares some key aspects of different services (Note: This is a simplified example and specific features and pricing can vary).

| Service | Features | Pros | Cons |

|---|---|---|---|

| Service A | Credit monitoring, dark web scanning, identity restoration | Comprehensive coverage, user-friendly interface | Higher cost, some features may be redundant for low-risk individuals |

| Service B | Credit monitoring, fraud alerts | Affordable, basic protection | Limited features, may not cover all aspects of identity theft |

| Service C | Dark web monitoring, identity restoration assistance | Strong dark web monitoring, proactive approach | Higher cost, may not include credit monitoring |

Recovery and Remediation Strategies

Recovering from identity theft can be a daunting process, but taking swift and decisive action is crucial to minimizing long-term damage. This involves a multi-pronged approach encompassing reporting to relevant authorities, actively correcting inaccurate information, and implementing preventative measures to avoid future incidents. The steps Artikeld below provide a framework for navigating this challenging situation.

The initial steps focus on damage control and reporting. This ensures that the appropriate agencies are aware of the situation and can begin to assist in the remediation process. Simultaneously, you should begin to compile a record of all affected accounts and transactions.

Reporting to Credit Bureaus and Law Enforcement

Promptly reporting the theft to the three major credit bureaus—Equifax, Experian, and TransUnion—is paramount. This initiates a fraud alert or security freeze, preventing new credit accounts from being opened in your name. You can file a fraud alert online through one bureau, which will automatically notify the others. A security freeze, while more protective, requires separate action with each bureau. Contacting law enforcement is equally important; filing a police report provides official documentation supporting your claims when dealing with creditors and other agencies. Retain copies of all reports and correspondence.

A Step-by-Step Guide for Identity Theft Victims

A systematic approach is essential for effective recovery. The following steps provide a structured guide:

- File a police report: Obtain a copy of the report for future reference. This report is crucial evidence.

- Contact the credit bureaus: Place a fraud alert or security freeze on your credit reports. Obtain confirmation numbers.

- Review your credit reports: Carefully examine your reports for any unauthorized accounts or suspicious activity. Dispute any inaccuracies.

- Contact creditors and financial institutions: Inform them of the identity theft and request closure of compromised accounts. Keep records of all communication.

- Change passwords and security questions: Update all online accounts with strong, unique passwords. Use multi-factor authentication where available.

- Monitor your accounts: Regularly review your bank statements, credit card statements, and other financial documents for any unauthorized transactions.

- Consider identity theft insurance: This can help cover the costs associated with recovery, such as legal fees and credit monitoring.

Sample Letters to Creditors and Agencies

Effective communication is key. Clearly outlining the situation in a formal letter to creditors and agencies ensures your concerns are addressed promptly. Below are examples of letter templates. Remember to personalize these with your specific details.

Sample Letter to a Creditor:

To [Creditor Name],

This letter is to formally notify you of identity theft affecting my account, [Account Number]. Unauthorized activity has been detected. I request immediate closure of this account and a detailed report of all transactions. I have filed a police report (case number: [Police Report Number]) and contacted the credit bureaus.

Sincerely,

[Your Name]

[Your Address]

[Your Phone Number]

Sample Letter to a Credit Bureau:

To [Credit Bureau Name],

This letter is to report identity theft and request a fraud alert/security freeze be placed on my credit report. I have filed a police report (case number: [Police Report Number]). Please confirm receipt and the status of my request.

Sincerely,

[Your Name]

[Your Address]

[Your Phone Number]

Credit Freezes and Unfreezes

A credit freeze prevents new credit accounts from being opened in your name. While highly effective, it also prevents you from applying for new credit yourself. An unfreeze is necessary to temporarily lift the restriction for legitimate credit applications. The process of freezing and unfreezing typically involves contacting each credit bureau individually, either online or by phone. This requires a PIN or password that is generated upon freezing. Each bureau provides specific instructions on its website. The benefits outweigh the drawbacks in the immediate aftermath of identity theft, prioritizing protection over immediate credit access. However, remember to unfreeze your credit when you need to apply for credit.

Last Word

Protecting your identity requires vigilance and proactive measures. By understanding the signs of identity theft, implementing strong preventative strategies, and knowing the steps to take in case of compromise, you can significantly reduce your risk. Remember, consistent monitoring and a proactive approach are key to safeguarding your personal information and maintaining your financial well-being in an increasingly interconnected world. Take control of your digital footprint and secure your future.