Navigating the digital landscape requires vigilance. Online scams are increasingly sophisticated, preying on unsuspecting individuals through deceptive tactics and manipulative techniques. Understanding how these scams operate is the first step towards protecting yourself and your valuable information. This guide provides nine essential tips to help you identify, avoid, and prevent becoming a victim.

From recognizing the subtle cues of phishing emails to implementing robust security measures, we’ll explore practical strategies to safeguard your online presence. We will delve into common scam types, highlighting the warning signs and offering actionable advice to minimize your risk. By understanding the methods employed by scammers, you can significantly reduce your vulnerability and maintain a secure online experience.

Recognizing Common Scam Tactics

Online scams are becoming increasingly sophisticated, making it crucial to understand the tactics used by scammers to deceive their victims. Recognizing these tactics is the first step in protecting yourself from financial and emotional harm. This section will detail common methods employed by scammers, highlighting key characteristics to watch out for.

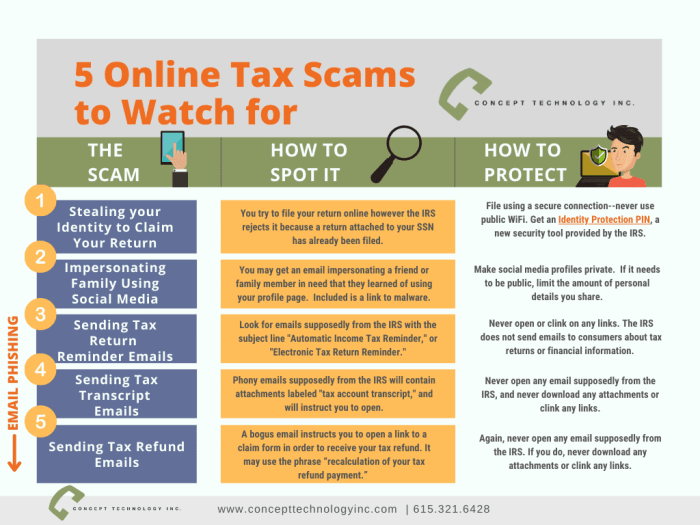

Phishing Emails and Their Characteristics

Phishing emails are designed to trick recipients into revealing sensitive information, such as usernames, passwords, credit card details, or social security numbers. These emails often appear to be from legitimate organizations, like banks, online retailers, or government agencies. Key characteristics include poor grammar and spelling, generic greetings (e.g., “Dear Customer”), urgent or threatening language, suspicious links or attachments, and requests for personal information. For example, a phishing email might claim your account has been compromised and require you to click a link to verify your information. This link would actually lead to a fake website designed to steal your credentials. Another example might be an email claiming a large sum of money is waiting to be claimed, requesting bank account details to process the payment.

Social Engineering Techniques in Online Scams

Social engineering involves manipulating individuals into divulging confidential information or performing actions that benefit the scammer. Common techniques include pretexting (creating a false scenario to gain trust), baiting (offering something enticing to lure the victim), and quid pro quo (offering a service in exchange for information). For example, a scammer might pretend to be a tech support representative to gain access to a victim’s computer, or they might pose as a romantic interest to build trust and then request financial assistance. The effectiveness of these techniques relies on the scammer’s ability to build rapport and exploit human psychology.

Comparison of Different Online Scam Types

Various types of online scams employ different methods and target different vulnerabilities. Romance scams, for example, exploit emotional connections to manipulate victims into sending money. Investment scams often promise unrealistic returns, while tech support scams prey on individuals’ fear of technical issues. Each type has its own set of warning signs. Romance scams might involve inconsistent communication, lavish promises, and requests for financial assistance. Investment scams may involve high-pressure sales tactics, promises of guaranteed returns, and lack of transparency. Tech support scams often involve unsolicited calls or emails claiming to detect problems on your computer.

Types of Online Scams, Methods, and Warning Signs

| Scam Type | Method | Warning Signs | Example |

|---|---|---|---|

| Phishing | Email, text message, or website mimicking a legitimate entity to obtain sensitive information. | Suspicious links, grammatical errors, urgent requests for personal information, unexpected emails. | An email claiming your bank account has been compromised and asking you to update your details through a link. |

| Romance Scam | Building a false romantic relationship online to manipulate victims into sending money. | Inconsistent communication, lavish promises, requests for financial assistance, inability to meet in person. | Someone claiming to be a wealthy foreigner needing financial help to visit you. |

| Investment Scam | Promising high returns with minimal risk, often involving cryptocurrency or other high-risk investments. | Unrealistic returns, high-pressure sales tactics, lack of transparency, unregistered investment firms. | An investment opportunity promising 20% monthly returns with no risk. |

| Tech Support Scam | Unsolicited calls or emails claiming to detect problems on your computer, often demanding payment for services. | Unsolicited contact, claims of critical computer problems, requests for remote access, high-pressure sales tactics. | A call from someone claiming to be from Microsoft, stating your computer is infected and needs immediate repair. |

Protecting Your Personal Information

In today’s digital landscape, safeguarding your personal information is paramount to avoiding online scams. Weak security practices leave you vulnerable to identity theft, financial fraud, and other serious consequences. This section Artikels crucial steps to bolster your online defenses and protect your sensitive data.

Robust security begins with a multi-layered approach encompassing strong passwords, two-factor authentication, and mindful information sharing. By implementing these strategies, you significantly reduce your risk of becoming a victim of online scams.

Strong Password Creation and Management

Creating strong and unique passwords is fundamental to online security. Weak passwords, such as easily guessable combinations like “password123,” are easily cracked by malicious actors. A strong password should be long (at least 12 characters), complex (incorporating uppercase and lowercase letters, numbers, and symbols), and unique to each online account. Password managers can assist in generating and securely storing these complex passwords, eliminating the need to remember them all. Regularly updating passwords, especially for critical accounts like banking and email, is also a crucial practice. For example, instead of “password,” consider a passphrase like “MyDogIsBrown123!” which is significantly harder to crack.

Two-Factor Authentication Implementation

Two-factor authentication (2FA) adds an extra layer of security by requiring two forms of verification to access an account. This typically involves a password and a second factor, such as a code sent to your phone via SMS or an authentication app. Even if a scammer obtains your password, they will be unable to access your account without the second factor. Implementing 2FA on all your important accounts, including email, social media, banking, and online shopping platforms, is highly recommended. Enabling this feature usually involves navigating to the account settings and selecting the 2FA option; the specific steps vary depending on the platform.

Risks of Sharing Personal Information Online and Mitigation Strategies

Sharing personal information online carries inherent risks. Over-sharing on social media, responding to phishing emails requesting personal details, or using unsecured Wi-Fi networks can expose your data to malicious actors. To mitigate these risks, be cautious about the information you share online, only use secure Wi-Fi networks (indicated by “https” in the URL), and avoid clicking on suspicious links or downloading attachments from unknown senders. Think twice before posting personal details such as your address, phone number, or date of birth on public platforms. Remember that once information is online, it’s difficult to completely remove it.

Securing Online Accounts and Personal Data: A Checklist

Regularly reviewing and updating your security practices is crucial. This checklist provides a structured approach to securing your online accounts and personal data:

This checklist ensures a comprehensive approach to online security, minimizing vulnerability to scams and data breaches.

- Use strong, unique passwords for all accounts and manage them with a password manager.

- Enable two-factor authentication (2FA) wherever possible.

- Be cautious about sharing personal information online and avoid suspicious links and emails.

- Only use secure Wi-Fi networks (look for “https”).

- Keep your software and operating systems updated with the latest security patches.

- Regularly monitor your bank accounts and credit reports for any unauthorized activity.

- Be wary of unsolicited phone calls or emails requesting personal information.

- Educate yourself and your family about common online scams and phishing techniques.

- Consider using a reputable antivirus and anti-malware program.

Identifying and Avoiding Suspicious Activities

Online scams often rely on tricking you into engaging with suspicious activities. Learning to identify these activities is crucial for protecting yourself from financial and personal data loss. By understanding common tactics and developing a healthy skepticism, you can significantly reduce your risk.

Identifying suspicious emails, websites, and messages requires a critical eye and a cautious approach. Legitimate organizations rarely use urgent or threatening language to pressure you into immediate action. They also typically avoid asking for sensitive information via email or untrusted channels.

Suspicious Email, Website, and Message Characteristics

Suspicious communications often exhibit several telltale signs. For example, emails may contain grammatical errors, misspellings, or use overly formal or informal language. Websites might have unprofessional designs, lack secure connections (indicated by the absence of “https” in the URL), or request personal information without a clear reason. Messages from unknown senders demanding immediate action should always raise suspicion. Be wary of emails or messages that urge you to click on unfamiliar links or download attachments from unverified sources.

Examples of Suspicious Links and Attachments

A link that looks slightly off, perhaps with extra characters or a different domain name than expected, should be treated with caution. For instance, a link purporting to be from your bank might subtly alter the domain name, such as using “bankofamerica.com.malwaresite.net” instead of “bankofamerica.com”. Similarly, attachments from unknown senders should never be opened. These could contain malicious software designed to steal your data or damage your computer. Always hover your mouse over links to preview the destination URL before clicking. Never open attachments from unknown or untrusted sources.

Verifying Information from Multiple Sources

Before acting on any information received online, it’s essential to verify its authenticity from multiple reliable sources. If an email claims your bank account has been compromised, contact your bank directly using the official phone number or website, not the one provided in the email. Cross-referencing information helps ensure you’re dealing with legitimate entities and not falling prey to deceptive tactics. This simple step can prevent significant financial and personal losses.

Red Flags Indicating a Potential Scam

The following are some key indicators that you might be dealing with a scam:

- Urgent requests for immediate action.

- Requests for personal information (passwords, bank details, social security numbers) via email or untrusted websites.

- Suspicious links or attachments from unknown senders.

- Grammatical errors or poor writing quality in emails or messages.

- Promises of unrealistic rewards or opportunities.

- Pressure tactics or threats.

- Unprofessional website design or lack of secure connection (absence of “https”).

- Requests for payment via unusual methods (e.g., wire transfer to an unfamiliar account).

- Unverified or unknown sender information.

Closing Summary

Protecting yourself from online scams is an ongoing process requiring consistent awareness and proactive measures. By mastering the art of recognizing suspicious activities, securing your personal information, and verifying information from trusted sources, you can significantly reduce your risk. Remember, staying informed and vigilant is your best defense against the ever-evolving world of online fraud. Implement these nine tips, and empower yourself to navigate the digital world with confidence and security.